MultiCharts NET Starter Edition Free Version is Now MultiCharts .NET for TWS

Contents

Unlike moving averages, Fibonacci retracements are fixed, making them easy to interpret. When combined with additional momentum indicators, Fibonacci retracements can be used to identify potential entry and exit points to trade on trending stocks. Fibonacci retracements are a popular form of technical analysis used by traders in order to predict future potential prices in the financial markets. If used correctly, Fibonacci retracements and ratios can help traders to identify upcoming support and resistance levels based on past price action.

We’ll discuss how traders can use these percentages, but the main point is that the levels outlined by them may correlate with significant levels in the market. Speed lines are an analysis tool used to determine support and resistance levels. They are not intended to be used as a standalone technical https://1investing.in/ indicator. Fibonacci retracements are designed to locate areas of support and resistance on a price chart based on numbers from the golden ratio converted into percentages. Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature.

Investment for all

How do we use this looking into past-sort of code-to use in current or future times- is yet to be understood.investigated. MY guess is that using this you can plot future fibonacci’s manually. Is quite excited in particular about touring Durham Castle and Cathedral. Now, all you must do is to simply place the Gann fan indicator on the chart. Make positive it overlays on top of the forty five-diploma line you previously drew.

This drawing software is based on a collection of diagonal trend traces, which are inclined or declined at different angles. William Delbert Gann was a trader who developed the technical evaluation instruments generally known as Gann Angles, Square of 9, Hexagon, and Circle of 360. Gann’s market forecasting methods are primarily based on geometry, astronomy and astrology, and historical mathematics. Finally, Gann angles are also used to forecast important tops, bottoms and changes in pattern. This is a mathematical approach generally known as squaring, which is used to determine time zones and when the market is prone to change direction.

By drawing Fib retracement lines over an uptrend, traders can get an idea of potential support levels that may be tested in case the market starts to retrace – hence the term retracement. There’s a wide range of technical analysis tools and indicators that traders may use to try and predict future price action. These may include complete market analysis frameworks, such as the Wyckoff Method, Elliott Wave Theory, or the Dow Theory.

Fibonacci speed and resistance-how to use this

Analyze charts, create powerful C# strategies and place live trades—start your trading career with professional software at no cost. Andrew’s Pitchfork is an analytical drawing tool that consists of three parallel lines drawn from three user-defined points, usually major tops and bottoms . Once the points have been placed, a straight line is drawn from the first point that intersects the midpoint of the other two. If the trend was down, the retracement would be based on a high to low trend line. But the greatest benefit of the retracement might be understanding the concept of the self-fulfilling prophecy. You’ll still have to study your butt off and you might even decide to use Fibonacci retracements as part of your strategy.

Another approach to determine the support and resistance is to combine angles and horizontal strains. For instance, usually a downtrending Gann angle will cross a 50% retracement degree. The similar could be mentioned for uptrending angles crossing a 50% level. If you have an extended-time period chart, you will sometimes see many angles clustering at or near the identical value.

Adjacent numbers produce the inverse of phi, or 0.618, corresponding to a 61.8 percent retracement level. Numbers two positions apart in the sequence produce a ratio of 38.2 percent, while numbers three positions apart produce fib speed resistance fan a ratio of 23.6 percent. They can be used to estimate support or resistance levels and to define the trend. The first line extends from the low to the high in an uptrend or from the high to the low in a downtrend.

- The Fibonacci levels also point out price areas where you should be on high alert for trading opportunities.

- This is a mathematical approach generally known as squaring, which is used to determine time zones and when the market is prone to change direction.

- Analysts can also use retracements to provide arcs or followers utilizing arithmetic or logarithmic scales.

- The forty five-degree line should extend out forty five-levels from the place to begin.

The Gann Square is among the best known technical evaluation instruments created by WD Gann together with the Gann Fan and Gann Box. It is considered a cornerstone of his trading method that is based on time and worth symmetry. The Gann Square is a sophisticated software and utilizing it correctly requires a base level of information about Gann principle and some expertise with charting. Because of the relative ease traders today have at putting Gann angles on charts, many merchants don’t feel the need to truly discover when, how and why to make use of them.

Auto Fib Speed Resistance Fans by DGT

They are spaced at the Fibonacci intervals of 1, 2, 3, 5, 8, 13, 21, 34,etc. At this level, you can also get rid of the earlier Gann fan angles drawn from the swing excessive. This will ensure your chart won’t get cluttered and the value is still visible.

Once you have chosen your swing low point, merely utilize the trend Angle device and draw an ideal forty five-diploma angle. According to Gann concept, there are special angles you can draw on a chart. They will give you a great indicator of what the worth goes to do sooner or later. It would be safer to wait for price action to unfold and assess whether the key support level holds. A close above 15,550 would indicate that the worst is over and the index is on course to move towards the target zone of 16,800-17,000. A Parallel line is a tool used to draw a line parallel to an existing trendline.

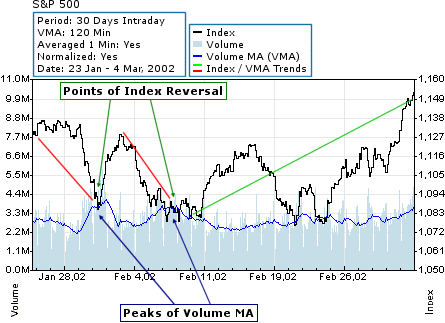

The vertical strains, which correspond to time on the x-axis of a value chart, are based on Fibonacci numbers. Traders can use the traces of the Fibonacci fan to foretell key factors of resistance or help, at which they could expect worth trends to reverse. If you’ve been following all of those steps, all the different Gann fan angles ought to adjust to the Gann rules. The next step is to pick any major swing excessive or swing lows on the chart from where you draw the Gann fan angles.

The typically-debated matter of dialogue amongst technical analysts is that the past, the present and the longer term all exist on the identical time on a Gann angle. This trading strategy is a complex assist and resistance buying and selling technique. Unlike the traditional horizontal support and resistance levels, the Gann fan angles are mathematically calculated based mostly on the value, time and the value vary of the market. Traders will draw a Gann fan at a reversal point to see support and resistance levels extended into the future. The 45-degree angle line of the Gann Fan should be aligned with a 45-degree angle on the chart.

The Fibonacci Sequence is a series of numbers that seem to consistently occur in nature. Fibonacci Arcs are displayed by first drawing a trendline between two extreme points, for example, a trough and opposing peak. A common technique is to display both Fibonacci Arcs and Fibonacci Fan Lines and to anticipate support/resistance at the points where the Fibonacci studies cross.

The signs of a completion of the recent correction are not visible either. While a close below 4,100 would mark the dawn of a long term downtrend, a close above 4,550 would indicate the resumption of the earlier uptrend. While the global sell-off did have an impact on domestic market, it is positive to notice that the crucial support at 14,500 was not breached. Tijori Finance a sleek design portal to access in-depth data such as market share, revenue break-up, location exposure, operational metrics shareholding & financial on… Speed is the slope of fib level line price follows effectively-possibly. When the speed is really more,price can shoot to unfair high levels or low levels.

Many agricultural commodities trade on stock and derivatives markets. If you wish to learn to appropriately trade horizontal support and resistance ranges, we’ve obtained your again. I guess using 52 week low for begin bar and 52 week high for end bar

would be good common-place scenario. How to use it to infer future events is totally left to us to identify. I’ve only done basic R&D and concluded that for best results, Beginbar has to be set to nearest low. I guess using 52 week low for begin bar and 52 week high for end bar would be good common-place scenario.

What Are Fibonacci Retracements And How To Use Them?

Unlike indicators like moving averages, Fibonacci retracement levels do not change. They are static in nature and allow traders to quickly and easily identify them for any given period. Investors also use them to anticipate and react quickly when the price tests these levels, creating inflection points where either a reversal or a break is expected. As with other techniques, the Fibonacci retracement tool is at its most powerful when combined with other technical analysis indicators. What may not be a buy or sell signal on its own could turn into one if confirmed by other indicators. As such, if the price hits a specific Fibonacci level, it may reverse, or it may not.

Unlike the normal horizontal help and resistance levels, the Gann fan angles are mathematically calculated based mostly on the value, time and the price vary of the market. MultiCharts .NET Starter Edition was designed for small cap traders to ease the burden of buying expensive software when starting out. Enjoy all features of regular MultiCharts .NET and use up to two symbols at a time absolutely free.